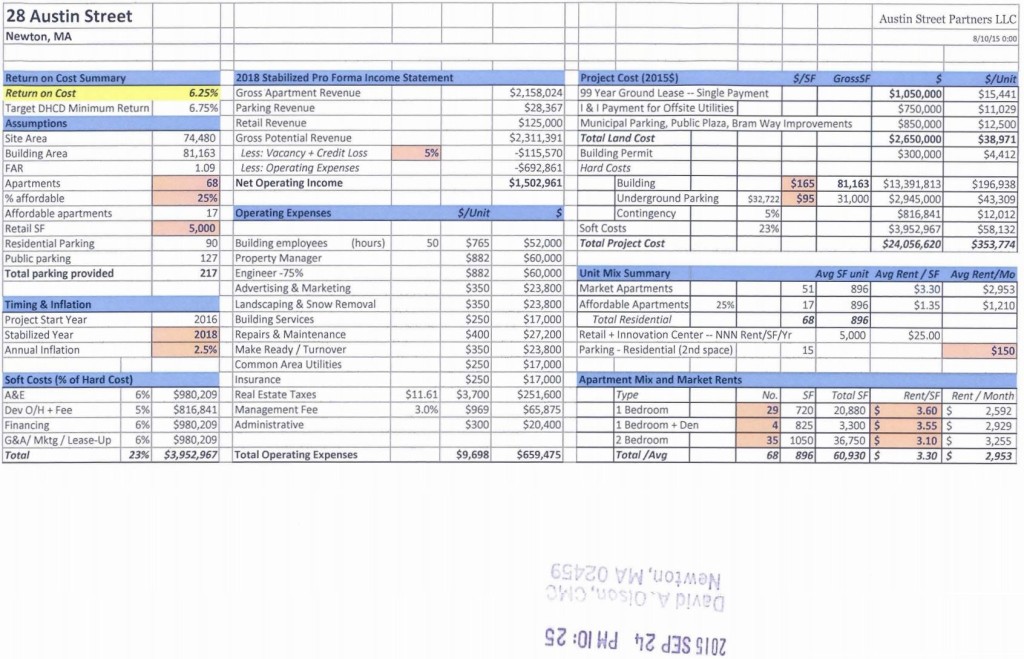

Below is the Austin Street Partners Pro Forma submitted to the city and Board of Alderman in September 2015. It formed the basis for assessing whether the city was getting a fair deal in terms of affordable units and land price. While the project was approved by the Board of Alderman in December 2015, it is currently on hold pending an appeal and resolution of a citizen lawsuit (complaint, Boston Globe article, dismissal of lawsuit).

Why revisit the Pro Forma now?

It is likely that it will continue to be important to understand the project’s finances for several reasons:

- There was much discussion about the extent to which the city negotiated a favorable deal with Austin Street Partners (ASP) for the city. The pro forma was key in rationalizing the fairness of the deal. This will likely be revisited in the next round of elections.

- The project was not reassessed financially from the point of view of the city or developer after the last-minute increase in the number of affordable units in the project. The developer cautioned that financing the revised project might be difficult Finances may need to be revisited if the developer comes back to the city for a subsidy or for a change in the number of affordable units.

The first step in understanding the project finances is to understand the assumptions in the pro forma itself. The original pro forma is a scanned/rotated pdf file that is difficult to read. You can click on the image below to get a good look at it:

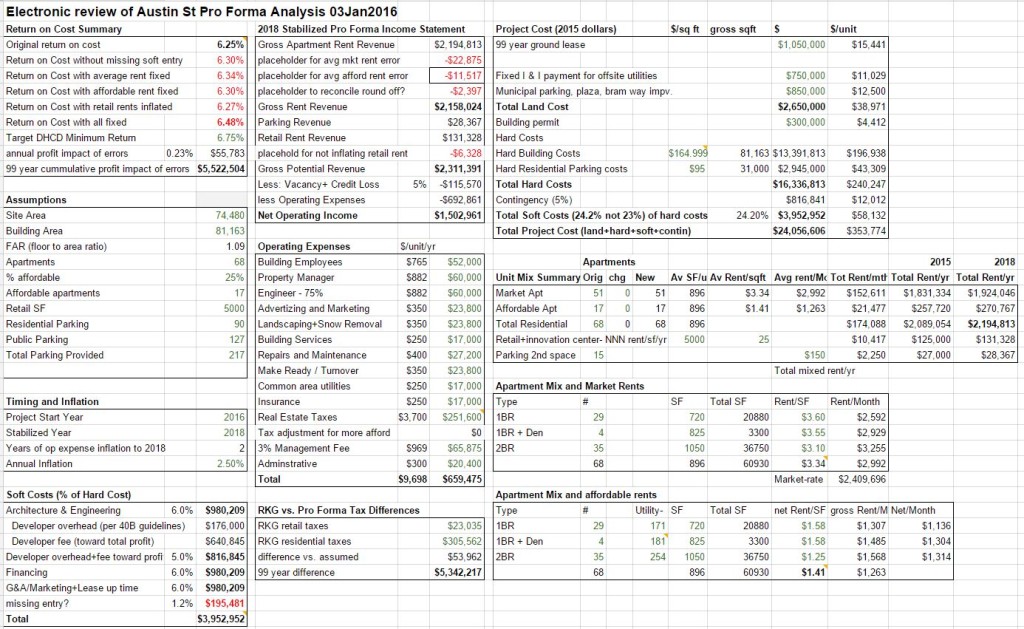

Below is a snapshot of a Google Spreadsheet which recreates the ASP Pro Forma. Click on image below for a full-sized view:

Note that the google spreadsheet will evolve over time as improvements and corrections are made.

There currently appear to be 5 mistakes made in the spreadsheet used by ASP to generate the original Pro Forma provided to the City of Newton in September 2015:

- The pro forma does not properly weight the unit mix in calculating the average market rate rent per square foot, which works out to $3.34, not the $3.30 unweighted average used by ASP. This increases the return by 0.09%

The reason for this error is that the 2BR apartments have a lower cost per square foot, but there are less of them. So for example, if you have a building with 1 2BR at $3/sqft and 9 1BR at $4/sqft, the average of those two numbers is $3.50/sqft, but the average cost/sqft in the building is (1 x 3 + 9 x 4)/10 = $3.90. - The soft cost total is shown as $3,952,967, but the 4 enumerated items (3x$980,209 + $816,845) sum up to only $3,757,486, which is 23% of soft costs. The $3,952,967 value passed to the total project cost is 24.2% of hard costs – 1.2% over the 23% 40B allowance. Using the lower value increases the apparent return of the project by 0.05%.These 4 numbers don’t add up:

- Due to a similar calculation mistake as in #1, the weighted average affordable rate rent after utility adjustment works out to 1.41/sqft not $1.35/sqft. This raises the return by 0.05%

- The retail rent of $25/sqft was not inflated by 2 years, understating rental income. This raises the return by 0.02%

- The gross rent estimate appears to be understated by an additional $2,397 for unknown reasons.

The net effect of these 5 issues is to raise the projected return from 6.25% to 6.48% or about $5 million dollars.

While this may be a small change on a percentage basis, it is important for a number of reasons:

- Much was made the difference of 6.25% vs. 6.75% target in rationalizing that the project as fair to the city.

- All else being equal, when valued over time, the errors could translate to an increase in immediate resale value of the project of over $5 million.

- The missing value in soft costs, if added, increase the developer profit fee to $836,326.

- The missing value is equivalent to the cost of three affordable units — i.e. adding 3 additional units from the original proposal brings it to at 6.25% return.

The spreadsheet also includes the capability to estimate the return with the 6 additional affordable units added just prior to board approval. The return of the revised project is currently estimated at 6.03%.

[SUBSEQUENT UPDATE]

Now the above are unarguable careless mistakes in calculations. One next needs to consider the assumptions. The pro forma assumes a market rate for new construction retail of $25/sq ft. A prominent Orr block tenant looking for space conveyed that actual market rate is north of $50/sq ft. That difference is worth $15 million.

The RKG analysis assessing benefit to the city assumed $300K/yr in tax payments to the city while pro forma assumed $250K. While this raises the projected return, it suggests the RKG analysis may overestimate the projects benefit to city finances. The tax revenue difference over time adds up to $5.3 million less going to city than assumed by RKG analysis.

All totaled, the pro forma errors and favorable retail assumptions above appear to translate to Austin Street Partners understating the project’s value to the city and the public by approximately $20 million.

Time will tell if the residential market rate assumptions were favorable as well.

———

Note that resale value and developer profit depends on items enumerated in the pro forma as well as a number of other factors including but not limited to:

- how efficiently ASP executes the project relative to pro forma assumptions

- the financing interest rate obtained by the projects buyer

- the perceived value of having use of the land for 198 years (e.g. for future construction additions)

- Potential increases in rental rates above inflation (e.g. if the village actually got frequent subway-like service to/from Boston on rail line)

- Expectation that long-term interest rates might increase over rates available to lock in today.

- any subsidies obtained by ASP for the additional affordable units offered.

For terminology definitions see Massachusett 40B Guidelines and 40B Preparation Guidance. The Allowable Developer overhead for 68 Units is $80,000+ 48*$2000 = $176,000, so the developer fee (profit) component of the overhead+fees is $640,845.

Please comment with corrections/clarifications.

Update: The analysis above was solely to point out math errors in the Austin St. Pro Forma that added up to a $10 million dollar favorable windfall to the developer.

It has subsequently been pointed out by a Newton retailer looking for new space that the going rate for new construction retail space is $50/sq ft compared with the $25/sq ft assumption used by Austin St. Partners.

Updating the Pro Forma with that assumption adds another $10 million dollar windfall to the developer for a total of $20 million favorable.

https://docs.google.com/spreadsheets/d/1C_9dk_G2iwvpB8KZEK5EwJECWqT1RB_vRglbv65OXYM/edit#gid=0

This raises the initial return of the project to 7.12% compared with the 6.25% claimed.